Most people have at least one type of insurance. If you have a mortgage your bank or loan provider will insist on building insurance and possibly life cover. If you drive, by law you must have car insurance and if you go on holiday most of us will take out travel insurance.

With that in mind why do so many exporters and importers ship their goods without taking out some kind of marine insurance?

When researching this piece I googled the word Insurance to find a concise meaning I could use and was amused to read the following….

insurance

a thing providing protection against a possible eventuality.

“jackets were hung on the back of their chairs, insurance against an encounter with air-conditioning”

In the shipping world here’s why you need more protection than a jacket on the back of your chair.

You’ve spent weeks making your products or gathering stock for your new client. They are desperate for your goods. You book your transport, load the container and this is then loaded on the vessel. Finally the ship sails and as far as you are concerned, your order is as good as delivered to your customer. What could possibly go wrong? Well actually quite a lot.

Many will remember that in 2021 a vessel got stuck in the Suez Canal. The Ever Given, a 400 meter long cargo ship weighing 220,000 tons with 17,600 containers on board. This huge vessel blocked this vital trade route in both directions, resulting in a back log of more than 400 ships. Eventually the vessel was freed but not all maritime incidents have such a positive outcome.

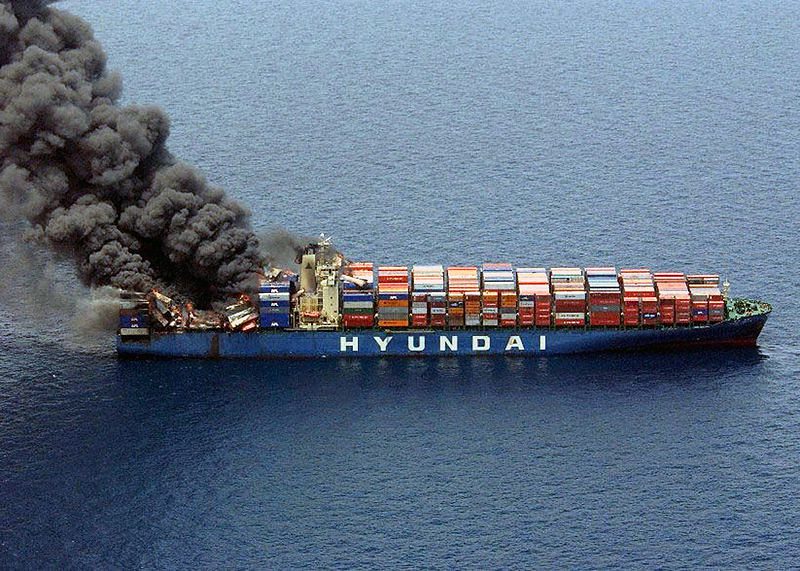

A powerful explosion aboard this vessel caused this ship, the Hyundai Fortune to catch fire in the Gulf of Aden. The ship was eventually towed to Oman where it was determined a third of the containers on board had been damaged in the fire.

This vessel, MSC Napoli developed a crack in the hull whilst at sea after encountering heavy weather in the English Channel. All 26 crew members abandoned ship leaving the vessel adrift off Cornwall. Salvage crews were called and intentionally beached the vessel to stop it breaking up at sea. Then It was determined the vessel was in too poor a state to tow so the salvage crew used explosives to break the ship into three sections. Each section was then removed individually. The salvage operation was eventually completed after almost 3 years, (924 days). How much must that have cost?

The MOL Comfort split in two in the Indian Ocean only 5 years after being built. All crew members safely abandoned ship but both sections of the vessel eventually sank with all containers lost at sea. Accidents do happen, quite regularly, many are not so serious and only cause a delay in the transit but when the worst happens, how does this effect you, the shipper or importer of the goods.

If a cargo vessel runs aground and can’t be re-floated, or it breaks up or catches fire, crashes sinks, or hits bad weather and loses your container over the side, the person or company paying the freight will be compensated in line with the carrier’s contract of carriage on the back of the bill of lading.

Paragraph 7 is entitled Compensation and Liability Provisions. This details the compensation the carrier will pay to the party paying the freight in the event of the loss of the container. Those with binoculars or much better eyesight than I have will see It reads $500 per package.

At this point if you are shipping a number of packages in the container, let’s say 100 cartons, you would think that you would be recompensed 100 x $500 but that is NOT the case. The carrier deems the container to be ONE package and this will be stated on the front of the bill of lading.

This means that if your container of expensive products valued at a King’s ransom is washed overboard and totally lost, the shipping line will pay you the massive sum of $500. Oh and by the way, you will still be expected to pay the freight and surcharges associated with the freight, Fuel surcharge. Etc. Believe it or not that is not the end of the bad news. In the event that the vessel owners decide to try and salvage the ship and / or it’s contents, under maritime law, all parties with cargo on the vessel are legally obliged to pay a share of the cost of the salvaging the vessel and its cargo.

So you made your goods, worth £50,000, shipped them, are paying freight and related charges of £5500 and your container as ended up here. £500 is not really going to cover your expenses. So why wouldn’t you insure your goods against this happening?

International trade and shipping in particular is fraught with pitfalls. Freight Agency help you minimise the risk and insure your shipments to ensure you are protected against as many of these pit falls as possible.